This age of fitting, customization and personalization can present a serious challenge for those seeking to identify the perfect holiday present for the obsessed golfer in their lives.

But fear not, as a lifestyle sport played by millions of passionate participants in need (or want) of equipment, apparel, accessories and more, golf is always well-represented during the winter holiday season. This year, that means a slice of an overall spending pie the National Retail Federation (NRF) estimates to be between $980 billion and $989 billion in the U.S., up between 2.5% and 3.5% over last year.

Approximately half of Core Golfers – the group of almost 13 million golfers responsible for over 90% of golf spend – say golf gifting for themselves or others is a part of their holiday routine. The “self-gifting” part likely speaks to the challenge family and friends have in buying for serious (picky) golfers…

What’s also notable is that this engaged group of Core golfers in recent years indicate they spend (or plan to spend) about 50% more than the typical American shopper.

Whether golfers are making purchases at a specialty golf retailer such as PGA TOUR Superstore, Worldwide Golf Shops or Golf Galaxy, or through a channel like Amazon, NGF consumer surveys show a growing percentage of golfers are buying golf-related items online. This mirrors a broader societal trend, even if golf generally tends to be a bit slower to evolve. And, based on feedback from retailers, the expectation is that this will continue through the holiday season and into 2025.

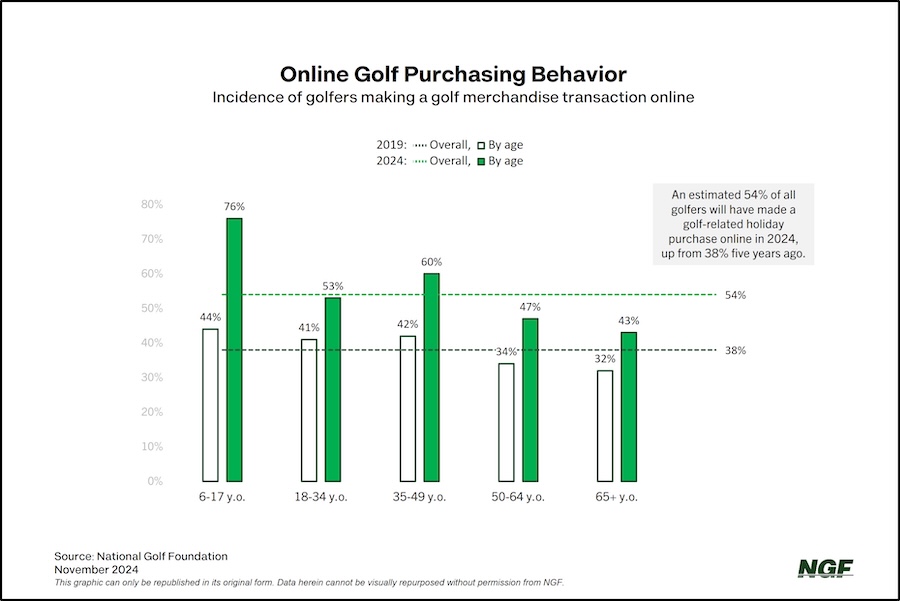

The majority of golfers (54%) indicate they have purchased golf-related merchandise online in the past 12 months. This is up from 38% prior to the pandemic in 2019.

Not surprisingly, younger golf consumers (those under 50 years old) are significantly more likely to have purchased something online than their older counterparts, with consumables such as golf balls, gloves, tees and apparel typically being among the most popular items. At first glance, it’s likely eye-opening to some that young adults make online purchases at a lower incidence than the 35-49 age group, but the 18-34 demographic may face lower disposable income as well as a price sensitivity that drives in-store comparison shopping. Meanwhile, the 35-49 age cohort encompasses many golfers in their peak earning years, those with established golf habits, and parents who are making a multitude of purchases given the uptick in family participation.

As Black Friday and Cyber Monday sales fast approach, it’s important to note, however, that these purchasing habits aren’t mutually exclusive.

Golf clubs, being more tactile for consumers in terms of look and feel, are far more frequently purchased in-person. Therefore, it comes as no surprise golf retail stores and clubfitters are continually enhancing their experiential component – from putting greens to simulators or screens with high-tech launch monitors – even as they expand and improve their online presence as a complement.

Broadly speaking, though, the NRF says online shopping (and other non-store sales) are expected to increase as much as 9% this holiday season to a total of high as $298 billion.

The golf industry is a part of that evolution. Based on golfer feedback, we can likely expect similar purchasing behavior momentum. The only question is how big is golf’s piece of the holiday spending pie?

No comments:

Post a Comment